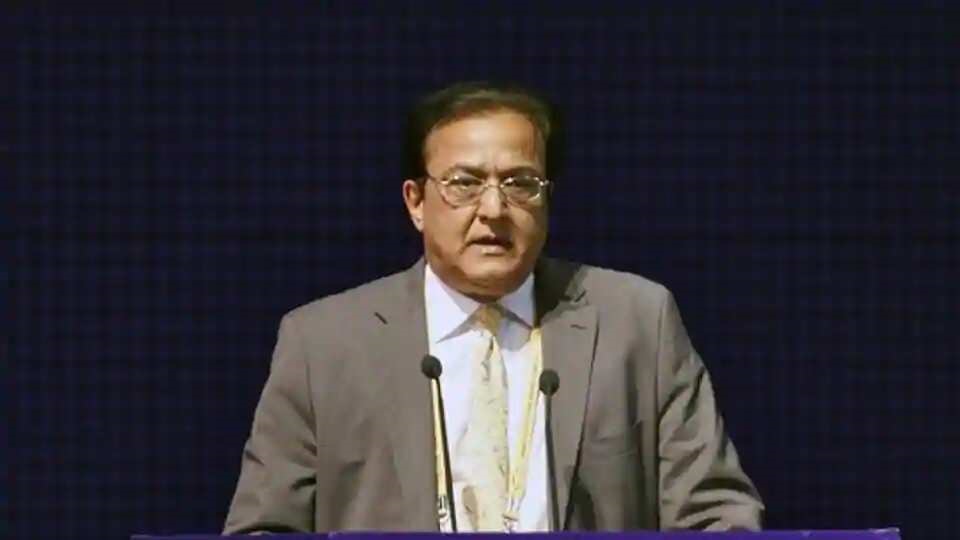

Mumbai: ED Raids Yes Bank’s Former CEO Rana Kapoor’s Worli residence in Mumbai

The official said Kapoor was being questioned in connection with the bank’s exposure to troubled reality firm Diwan Housing Finance Corporation (DHFL).

The Enforcement Directorate is conducting raids at Yes Bank’s founder Rana Kapoor’s Mumbai residence on Friday night, said an official privy to the development.

The official said Kapoor was being questioned in connection with the bank’s exposure to troubled reality firm Diwan Housing Finance Corporation (DHFL).

An ED official, who didn’t wish to be named, said raid at Rana Kapoor’s residence was linked to the agency’s money laundering probe related to DHFL, which is accused of siphoning off around Rs 13,000 crore with the help of 79 fictitious companies and one lakh fictitious customers.

The raids come on a day finance minister Nirmala Sitharaman had spoken about Yes Bank’s funding of stressed corporate such as DHFL as one of the reasons for its failure.

“The exposure of Yes Bank to some of the very stressed corporates has been since before 2014, like Anil Ambani group, Essel group, DHFL, IL&FS and Vodafone. All this information is in the public domain,” she had said in a briefing earlier today.

The government had questioned the decisions taken by the Bank’s top management and it was reported that a probe by Securities and Exchange Board of India (SEBI) had been initiated to check for insider trading by senior bank officials.

The raiding team found Rana Kapoor at his residence at ‘Samudra Mahal’ in Worli but authorities at ports and airports have still been alerted as per the official protocol to ensure that a person required for an investigation doesn’t leave the country, said the official.

The bank’s board had been set aside and RBI has appointed an administrator Prashant Kumar to run its affairs for the next 30 days, during which efforts are being made to bail it out of the current crisis.The bank will not be able to grant or renew any loan or advance, make any investment, incur any liability or agree to disburse any payment during the period.

Yes Bank stocks plunged by 57.3 per cent intra-day to Rs 15.70 apiece on Friday and the stocks of the public sector State Bank of India also dipped by 6.48 per cent after it announced that its board had given in-principal nod to investment in Yes Bank.