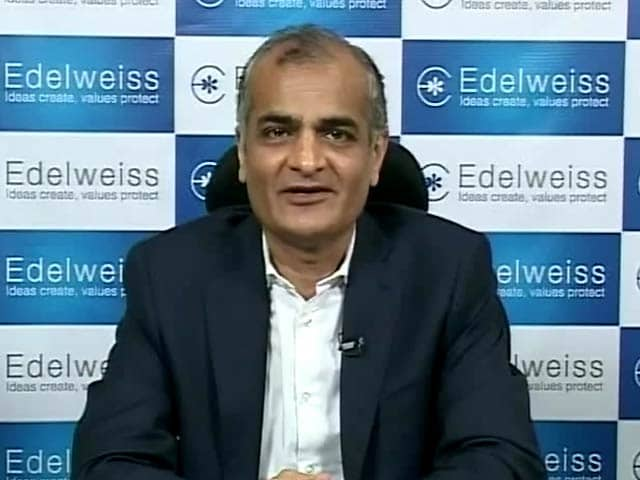

Edelweiss Group chairman Rashesh Shah Under probe in violations of foreign exchange rules amounting to more than. Rs 2,000 crore by Enforcement Doctorate

By Rashmi Rajput & Jaikishan Yadav

MUMBAI: Edelweiss Group chairman Rashesh Shah was asked to join an Enforcement Directorate probe into alleged violations of foreign exchange rules amounting to more than. Rs 2,000 crore but he did not turn up for questioning and sought to appear at a later date, officials said on Friday. The agency is likely to issue fresh summons next week, they said.

The role of a major Indian movie production and distribution company is also under probe, they said without naming the entity.

Edelweiss Group issued a statement on Friday saying none of its companies had any transactions with Capstone Forex.

It also dismissed reports in a section of the media in this regard. “The summons was issued under certain sections of the Foreign Exchange Management Act (FEMA) on January 3 and Rashesh Shah was asked to join the probe on January 9, but he has sought a later date,” an official in the know of the development told ET on condition of anonymity. “We are starting with him to understand why Edelweiss was involved in these transactions. The other firms related to these transactions will also be called in due course.”

Capstone Forex allegedly created bogus tourist lists and illegally remitted foreign exchange overseas, according to officials. “In order to provide credit balance to this company, Edelweiss Group companies and another firm under probe allegedly issued cheques to this Thane-based company for buying dollars and transferring under current account. These dollars were remitted to shell companies, which subsequently withdrew the money mostly through cash,” said a second official.

“There has been fraud at two levels – one, foreign exchange was illegally remitted by creating a bogus list of travellers and, second, a corporate like Edelweiss Group helped in illegal procurement of foreign exchange,” said the official. “While the major player in this looks to be the Edelweiss Group, the other entities which also helped provide credit balance to the Thane-based firm will be called in due course.”

The role of each party in the transaction is being ascertained, as are complex layers of transactions involved, said the official. “We want to probe who is the ultimate beneficiary of these shell entities and who floated them in the first place. Was this done with the dual intention of evading taxes and hoarding funds offshore?” said the official.

In its press statement, Edelweiss Group said, “We have received a communication from the Enforcement Directorate to appear and provide information about Edelweiss Group companies’ dealings with a company called Capstone Forex Pvt Ltd. We would like to state that none of our companies have any transactions with this company….”

“We further deny wild and baseless allegations contained in the news items which are apparently attributed to unidentified sources. We are in fact shocked at the spread of unauthenticated allegations and the inference being drawn from it,” it said.

The financial statement and director’s report of Capstone Forex, reviewed by ET, show that the company reported revenue of Rs 314.41crore from operations in March 2018, a whopping increase of nearly 1,800% from Rs 16.69 crore a year earlier. In March 2016, the company had reported a total income of Rs 4.89 crore.