Page 36 - CineBuster Vol-3 Issue-04

P. 36

N ATION

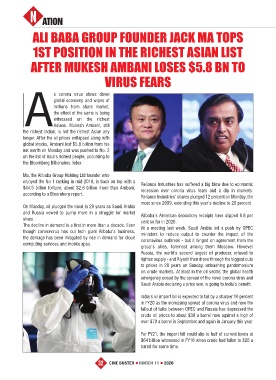

Ali BABA Group Founder JAck MA Tops

1sT posiTion in The richesT AsiAn lisT

AFTer Mukesh AMBAni loses $5.8 Bn To

Virus FeArs

A s corona virus slows down

global economy and wipes of

millions from share market,

the effect of the same is being

witnessed on the richest

Asians. Mukesh Ambani, still

the richest Indian, is not the richest Asian any

longer. After the oil prices collapsed along with

global stocks, Ambani lost $5.8 billion from his

net worth on Monday and was pushed to No. 2

on the list of Asia’s richest people, according to

the Bloomberg Billionaires Index.

Ma, the Alibaba Group Holding Ltd founder who

enjoyed the No 1 ranking in mid-2018, is back on top with a Reliance Industries has suffered a big blow due to economic

$44.5 billion fortune, about $2.6 billion more than Ambani, recession over corona virus fears and a dip in markets.

according to a Bloomberg report.

Reliance Industries’ shares plunged 12 percent on Monday, the

most since 2009, extending this year’s decline to 26 percent.

On Monday, oil plunged the most in 29 years as Saudi Arabia

and Russia vowed to pump more in a struggle for market Alibaba’s American depository receipts have slipped 6.8 per

share. cent so far in 2020.

The decline in demand is a first in more than a decade. Even At a meeting last week, Saudi Arabia led a push by OPEC

though coronavirus has cut tech giant Alibaba’s business, ministers to reduce output to counter the impact of the

the damage has been mitigated by rise in demand for cloud coronavirus outbreak - but it hinged on agreement from the

computing services and mobile apps.

group’s allies, foremost among them Moscow. However

Russia, the world’s second largest oil producer, refused to

tighten supply - and Riyadh then drove through the biggest cuts

to prices in 20 years on Sunday, unleashing pandemonium

on crude markets. At least in the oil sector, the global health

emergency posed by the spread of the novel corona virus and

Saudi Arabia declaring a price war, is going to India’s benefit.

India’s oil import bill is expected to fall by a sharper 10 percent

in FY20 as the increasing spread of corona virus and now the

fallout of talks between OPEC and Russia has depressed the

crude oil prices to about $30 a barrel now against a high of

over $70 a barrel in September and again in January this year.

For FY21, the import bill could slip to half of current levels at

$64 billion witnessed in FY16 when crude had fallen to $26 a

barrel for some time.

32 CINE BUSTER n MARCH 15 n 2020